Pessoa Física

Pessoa Física चे वर्णन

Application of the Brazilian Internal Revenue Service for Individuals. In this version of the Individual APP is available the following services:

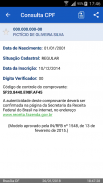

CPF Services:

- See information on the CPF;

- Generation of proof of enrollment (card) CPF;

- CPF registration - 1st line (1);

- Regularization of suspended CPF (1);

- Questions and Answers about the CPF (1);

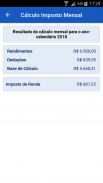

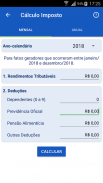

IRPF Services:

- See information on IRPF Refund (since 1999);

- Sending messages (alerts) on IRPF Refund;

- Quiz - an IRPF knowledge test

- Calculation of the monthly and annual tax, since calendar year 2012;

- Schedule of lots for payment of refund (1);

- Access to the IRPF website (1);

- Access to My Income Tax (2);

- Ask for IRPF (2);

- Accompany Statement (2);

Other services:

- Consultation CNPJ (3)

- RFB Units (1)

- RFB's website (1)

Operation:

(1) the application will call the service already available on the IRS page on the internet.

(2) the application will trigger the My Income Tax APP, provided it is installed.

(3) the application will trigger the CNPJ APP, provided it is installed.

Comments:

1) The CPF Consultation service verifies CADASTRAIS information in the bases of the Internal Revenue Service. There is no connection with private credit protection services (SPC, Serasa ...);

2) In order to consult a CPF, the date of birth must also be informed. The application, in addition to validating the date of birth informed, will display the date of creation of the CPF and the date of death (if any);

3) For registration CPF (1st way) is necessary to have voter's title.

4) The generation of the CPF registration form (2nd copy):

a) will only be allowed for taxpayers who did not present the tax return in 2017 and 2018;

b) taxpayers who filed an IRPF tax return in 2017 and 2018 must continue to generate their proof of CPF registration in e-CAC;

c) the name of the mother and / or the voter's title may be requested, depending on the situation of the taxpayer;

5) Regularization of the CPF is only possible for complementation of data of suspended registrations and of persons not required to file personal income tax returns.

6) The IRPF Refund consultation:

a) The result of the IRPF restitution can be consulted since 1999

b) If the refund is "waiting for", it may be indicated the interest in receiving alerts (must click on the yellow star);

c) Alerts will be sent when the refund of the taxpayer is sent to bank payment.

7) My Income Tax is a service that allows you to fill out, transmit and consult IRPF statements.